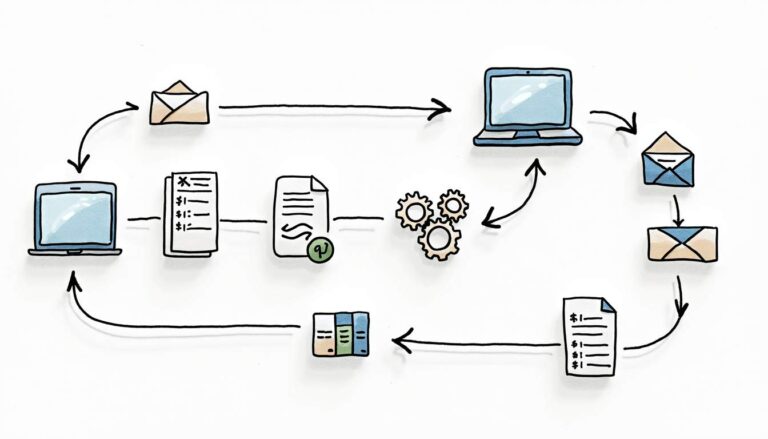

In simple terms, procure-to-pay (P2P) encompasses the entire journey from requisition to invoicing and everything in between including purchasing, receiving, paying and more. Just as the name suggests, the procure-to-pay cycle process begins with procuring the goods or services to finally paying for them. P2P is also often referred to as purchase-to-pay.

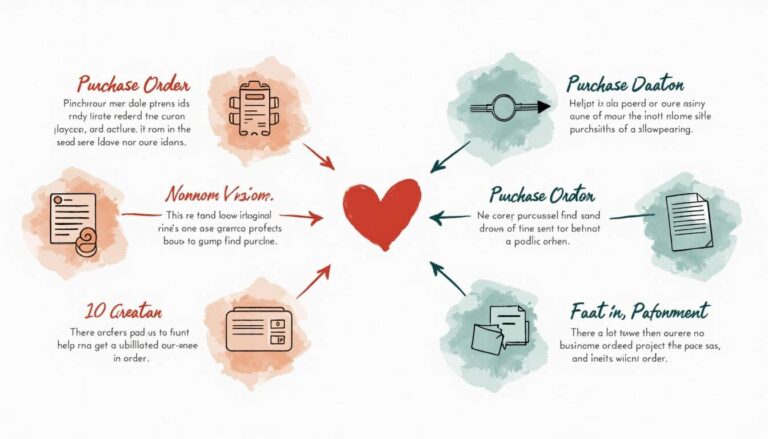

The Procure-to-Pay (P2P) Process

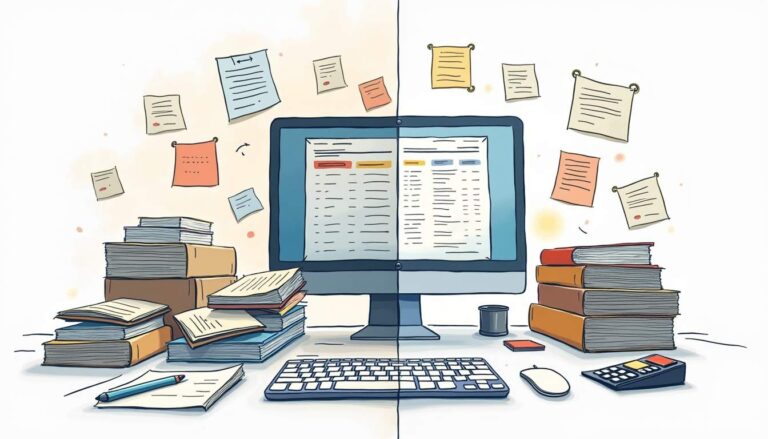

It goes without saying that the P2P process is more efficient when it is automated. The P2P process is complex without being automated and hence, most companies choose a procure-to-pay solution which can easily integrate into the existing processes.

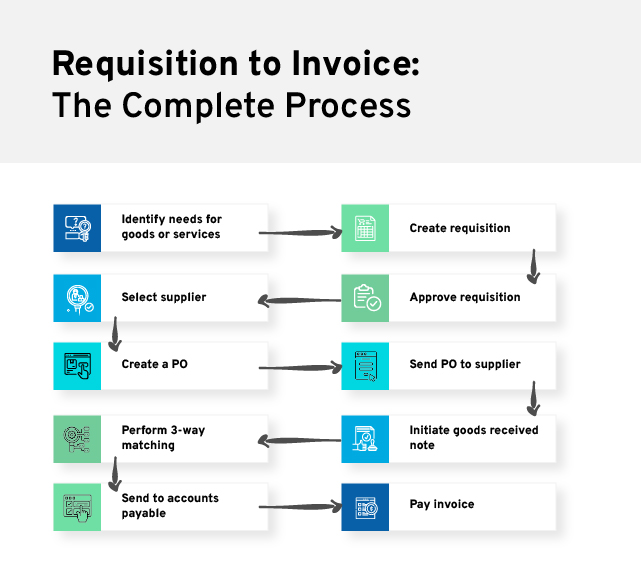

The P2P process can be customized as per every organization’s unique needs but here is what a general process looks like.

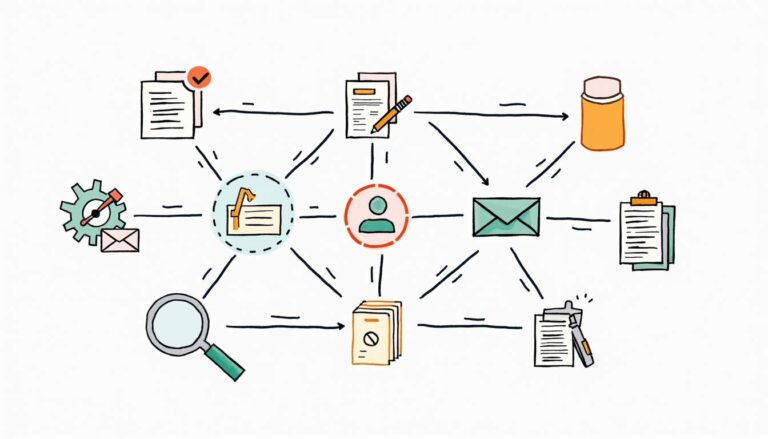

Step 1: Need identification

The very first step in the P2P process is to identify the needs. Determining and defining the needs of the business will always be the first step. Once this is done, the procurement teams sit together and brainstorm and plan out the specifications of the goods or services to be ordered.

Step 2: Creating a requisition

Once the needs are identified and the specifications of the goods or services are finalized, a formal purchase requisition is created. In this step, a requester submits a form i.e. a duly filled purchase requisition form to the purchasing department. The requester has to make sure all necessary administrative requirements are met while filling out the form.

Step 3: Approval of the purchase requisition

Once the requisition is created, it is submitted to the concerned departments and is reviewed by the department heads or purchasing managers. The approvers will evaluate the need and why the request was raised if it is within budget and then either approve or reject the purchase requisition form. If the submitted requisitions are incomplete, they are rejected and returned to the requester for resubmission.

Step 4: Creating a Purchase Order (PO)

If the submitted requisition form was complete and satisfied the need and was within budget, it will be approved. Once approved, purchase orders can be created from these purchase requisitions and submitted for approval.

Step 5: Approval of the purchase order

Once the PO is sent for approval, it is checked for the accuracy of the information provided on the order. Before approval, the POs pass through multiple approval levels. Once approved, the PO is submitted to the vendors and the vendors can either approve or reject the PO. They can even negotiate on this further. Once the PO is finally approved, it becomes a legally binding contract.

Step 6: Receiving the goods

The supplier has to then fulfill the order as per the PO. Once the goods are delivered, the buyer will inspect and check the goods if they are as per the contract terms. The goods receipt is either approved or rejected based on the contract terms and standards specified.

Step 7: Analyzing the supplier’s performance

The supplier is evaluated based on the previous step. If the goods delivered by the supplier are up to the mark and meet all the quality specifications, the supplier’s performance is considered to be good. Quality, the time required to deliver the goods, compliance, etc. are factors to be taken into consideration while analyzing the supplier’s performance.

Step 8: Approval of the invoice

Once the goods are received and approved, a three-way match is performed i.e. the purchase order, goods receipt and the invoice sent by the vendor are matched. If they match, they are then forwarded to the finance team for disbursement.

Step 9: Releasing payment to the vendor

Once the invoice is approved by the finance team, the vendor will receive payment from the finance team as per the terms of the contract. This completes the purchase-to-pay (P2P) process.

Conclusion

The P2P process helps organizations in improving efficiency and increases the overall bottom line of the company. The procurement process remains transparent which keeps maverick spending in check and this, in turn, streamlines processes and saves costs and time.