As a business owner or manager, it is crucial to have an effective expense policy in place. An expense policy defines the guidelines and procedures for managing employee expenses, ensuring transparency, control, and compliance within your organization. In this article, we will delve into the importance of an expense policy, the key elements to include, the steps to implement it, and how to monitor and update the policy to adapt to changing business needs.

Understanding the Importance of an Expense Policy

An expense policy serves as a foundation for managing expenses and plays a vital role in maintaining financial discipline within your business. It provides a clear framework for employees to follow when incurring and reporting expenses, minimizing the risk of fraud, errors, and abuse. By establishing an effective expense policy, you enable your employees to make informed decisions about expenditures while ensuring that the company’s resources are used wisely and in alignment with business objectives.

Defining an Expense Policy

The first step in implementing an expense policy is to define its scope and purpose. A well-crafted policy will outline what types of expenses are eligible for reimbursement, specify spending limits for various categories, and communicate the necessary steps employees need to follow when submitting expense reports. The policy should also address any unique requirements or conditions specific to your business.

Benefits of Having a Clear Expense Policy

Having a clear and comprehensive expense policy brings several benefits to your organization. Firstly, it promotes consistency and fairness by ensuring that all employees are subject to the same guidelines. This reduces the potential for favoritism or confusion about what is acceptable and what is not when it comes to expenses.

Secondly, an expense policy enhances cost control by setting limits on certain expenses. For example, you may establish a maximum amount for meals or accommodations during business trips. By doing so, you avoid excessive spending and ensure that expenses are reasonable and justifiable.

Thirdly, an effective expense policy minimizes the risk of errors and fraud. By clearly outlining the procedures for submitting and approving expenses, you create a system of checks and balances that helps prevent inaccurate or inappropriate expense submissions.

Furthermore, a well-structured expense policy can also contribute to employee satisfaction and morale. When employees have a clear understanding of what expenses are covered and how to submit them, they feel more confident and empowered. This clarity reduces the stress and uncertainty that can arise when dealing with expense-related matters, allowing employees to focus on their core responsibilities.

In addition, an expense policy can have a positive impact on your company’s reputation. By demonstrating a commitment to transparency and responsible financial management, you send a message to clients, partners, and stakeholders that your organization values integrity and accountability. This can enhance trust and credibility, leading to stronger relationships and potential business opportunities.

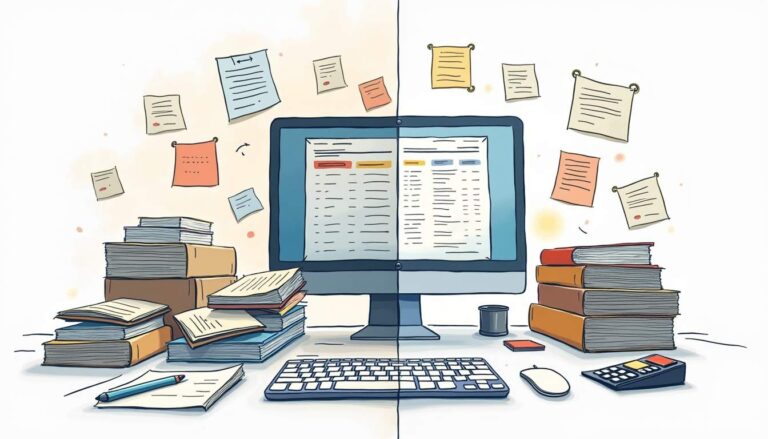

Lastly, an expense policy provides a valuable tool for monitoring and analyzing expenses. By collecting data on employee spending patterns, you can identify areas of potential cost savings or areas where additional training or guidance may be needed. This data-driven approach allows you to make informed decisions and continuously improve your expense management processes.

Key Elements of an Effective Expense Policy

Now that we understand the importance of an expense policy, let’s explore the key elements to include when creating one for your business.

An effective expense policy not only sets clear spending limits but also takes into account the specific needs and circumstances of your organization. By considering these factors, you can create a policy that not only controls costs but also supports your employees in their day-to-day activities.

Setting Clear Expense Limits

One of the main reasons for having an expense policy is to establish spending limits for different expense categories. This ensures that expenditures are reasonable and aligned with your company’s financial goals. For example, you can set a daily or monthly limit for meals, transportation, or accommodation expenses. Having clear limits helps control costs and prevent extravagant spending.

However, it’s important to strike a balance between controlling expenses and allowing flexibility for employees. By understanding the nature of your business and the expectations of your employees, you can set appropriate limits that foster productivity and satisfaction.

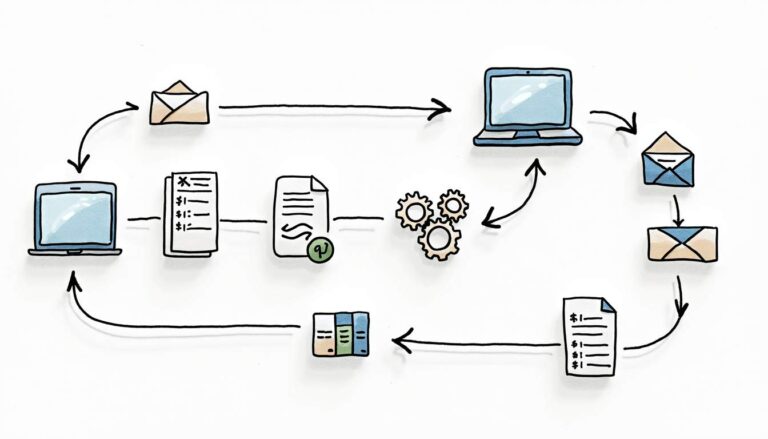

Establishing Approval Processes

It is essential to define a clear and efficient approval process to ensure that expenses are reviewed and authorized according to the policy. This process should specify who is responsible for approving expenses, the required documentation for each expense category, and any mandatory pre-approvals for certain expenses. By having a well-defined approval process, you create accountability and transparency within your organization.

Moreover, consider implementing a system that allows for easy and timely expense approvals. This can include utilizing expense management software or establishing a designated email address for expense submissions. By streamlining the approval process, you minimize delays and ensure that employees can focus on their core responsibilities.

Detailing Reimbursement Procedures

Another crucial element of an expense policy is to outline the procedures for reimbursing employees for their expenses. This includes specifying the timeline for submitting expense reports, the required supporting documentation, and the method of reimbursement (e.g., direct deposit or check). By detailing the reimbursement procedures, you streamline the process, reduce delays, and ensure that employees are promptly reimbursed for their eligible expenses.

Consider going the extra mile by providing resources or training to help employees understand the reimbursement procedures. This can include workshops or online tutorials that guide employees through the process, ensuring that they have all the necessary information to submit accurate and complete expense reports.

Remember, an effective expense policy is not just a set of rules and regulations. It is a tool that supports your employees, promotes financial responsibility, and contributes to the overall success of your business. By considering the specific needs of your organization and implementing these key elements, you can create an expense policy that is tailored to your unique circumstances.

Steps to Implement an Expense Policy

Now that you have a clear understanding of the key elements of an expense policy, let us explore the steps involved in implementing it successfully.

Drafting the Policy

The first step is to draft the expense policy itself. This should be a collaborative process involving the finance department, HR, and key stakeholders. Ensure that the policy reflects your business’s unique needs, culture, and industry regulations. Consider seeking legal advice to ensure compliance, especially if your business operates in multiple jurisdictions.

When drafting the policy, it is essential to consider various factors. For instance, you may want to include specific guidelines on expense limits, approval processes, and documentation requirements. Additionally, you might want to address any exceptions or special circumstances that may arise, such as business travel or client entertainment expenses.

Communicating the Policy to Employees

Once the expense policy is finalized, it is crucial to communicate it effectively to all employees. Use various channels such as company-wide emails, intranet portals, and team meetings to explain the policy’s purpose, key elements, and expectations. Encourage employees to ask questions and seek clarification if needed. By effectively communicating the policy, you ensure that every employee understands their responsibilities and obligations.

Consider creating a comprehensive communication plan to ensure that the policy reaches all employees. This plan may include targeted emails to different departments, informative posters displayed in common areas, and even interactive training sessions. By utilizing multiple communication channels, you increase the likelihood of employees receiving and understanding the policy.

Training Staff on Policy Adherence

Training is an integral part of implementing an expense policy successfully. Conduct dedicated training sessions or workshops to educate employees on how to adhere to the policy’s guidelines. Provide examples of acceptable and unacceptable expenses and demonstrate how to accurately complete expense reports. Consider using real-life scenarios to enhance understanding and practical application.

In addition to training sessions, you may want to develop online resources such as video tutorials or interactive modules. These resources can serve as a reference for employees to revisit whenever they need guidance on expense policy adherence. Furthermore, consider establishing a feedback mechanism where employees can ask questions or seek clarification even after the initial training sessions.

Monitoring and Updating Your Expense Policy

Creating an expense policy is not a one-time task. It is essential to regularly monitor its effectiveness and make necessary updates to ensure that it remains relevant and aligned with your business needs.

Regularly Reviewing the Policy

Set a schedule to review the expense policy periodically. This could be annually or whenever there are significant changes within your business. During the review process, evaluate the policy’s performance, identify any loopholes, and gather feedback from employees. Use this feedback to refine and improve the policy to address emerging challenges and changing business dynamics.

Adapting the Policy to Business Changes

As your business evolves, so will your expense policy. It is crucial to adapt the policy to reflect any changes in your industry, regulations, or company structure. Additionally, consider incorporating new technologies or software solutions that can streamline expense reporting and improve efficiency. By staying vigilant and proactive, you ensure that your expense policy remains up to date and fit for purpose.

Handling Policy Violations

Despite having a well-structured expense policy, violations may still occur. It is crucial to address policy violations promptly and consistently. Establish a clear process for reporting and investigating violations, and ensure that disciplinary actions are taken when necessary. By addressing violations effectively, you reinforce the importance of policy adherence and maintain the integrity of your expense management system.

In conclusion, implementing an expense policy is a critical component of sound financial management in any business. By understanding the importance of an expense policy, defining its key elements, and following a structured implementation process, you establish a foundation for responsible spending, compliance, and transparency. Regular monitoring and updating of the policy ensure that it remains relevant and effective as your business evolves. By maintaining a strong expense policy, you lay the groundwork for financial stability and long-term success.